English

Spanish

The Reality of Real Estate

HAR.com is your home for the facts

The reality of real estate is that the market is always evolving. There is a lot of misinformation being reported about the National Association of REALTORS® (NAR) settlement. We want you to have the facts. HAR has put together valuable resources and information about the settlement’s impact on home buyers and sellers as well as the benefits of working with a REALTOR®.

For Buyers

For Sellers

Frequently Asked Questions

Are agent commissions negotiable?

Yes. Compensation is currently negotiable and will continue to be negotiable. Compensation should always be negotiated between agents and the consumers they serve.

How does the settlement impact homebuyers?

MLS participants working on behalf of buyers would be required to enter into written agreements with their buyers before touring a home. These agreements can help consumers understand exactly what services and value will be provided, and for how much.

How does the settlement impact home sellers?

After the new rule goes into effect, listing brokers and sellers could continue to offer compensation for buyer broker services, but such offers could not be communicated via the MLS. The settlement expressly provides that sellers may communicate seller concessions — such as buyer closing costs — via the MLS provided that such concessions are not conditioned on the use of or payment to a buyer broker.

What do I do if my home is currently on the market?

After the new rule goes into effect, listing agreements should be amended to reflect that offers of compensation cannot be communicated via the MLS. The settlement expressly provides that sellers may communicate seller concessions — such as buyer closing costs — via the MLS provided that such concessions are not conditioned on the use of or payment to a buyer broker.

How will this impact VA loans?

-

On June 11, the VA announced a temporary policy allowing VA buyers to compensate their buyer broker directly while determining when a formal rulemaking process is necessary. NAR will continue to monitor and provide updates as they occur. The VA home loan guaranty program is a vital homeownership tool that provides veterans with a centralized, affordable, and accessible method of purchasing homes as a benefit they earned for their service to our nation. Under previous VA policies, veterans using the home loan benefit were prohibited from compensating their professional representative directly. This policy put VA buyers at a disadvantage in situations where offers of compensation are not offered from a seller, potentially forcing them to forego professional representation, choose a different loan product, or exit the market entirely.

Does the settlement change access to mortgages for buyers?

No. Under the settlement, buyers still have the same options when it comes to compensating their real estate representatives. That is, the listing brokers can compensate the buyer broker, the seller can compensate the buyer broker, or the buyer can compensate their broker directly. Based NAR’s interpretation of current guidance, buyers should still be able to get financing from Fannie Mae, Freddie Mac, and the FHA under these scenarios. NAR is working to verify that this interpretation will hold. However, none of these agencies will allow the buyer to finance a commission into the mortgage at this time.

Can real estate commissions be financed?

According to NAR, financing commissions is not feasible under the current structure of the residential mortgage finance system, and there is no clear short-term legislative or regulatory fix.

Can a buyer request the listing broker to pay compensation to the buyer broker?

Yes. According to NAR, a buyer can request the listing broker to pay compensation to the buyer broker.

Do I need to use a REALTOR® to buy a home?

It is the consumers choice to use a REALTOR®. However, the services REALTORS® offer are invaluable, such as their expert guidance, market knowledge, negotiation skills, ability to tackle complex contracts and much more. You can navigate the real estate market with confidence when you have a REALTOR®.

Will open houses be considered the first showing for unrepresented buyers and therefore require a signed Buyer Representation Agreement?

No. We do not believe that an unrepresented buyer at an Open House invokes the requirement of having a Buyer Representation Agreement in place.

Are renters required to sign a Buyer/Tenant Representation Agreement before touring a rental property?

The settlement only deals with properties for sale on this issue of buyer representation, and it does not address rentals or change anything about needing a written agreement prior to showing a rental property. It would still be a smart idea to have a conversation with the client about how the agent will be compensated and have the Buyer/Tenant Representation Agreement signed.

Value of Using a

REALTOR®

REALTORS® enhance the home buying and selling journey with their valuable expertise and collaborative approach. A REALTOR® is your trusted advisor.

Find a REALTOR®

Guides for Homebuyers

Resources for Homebuyers

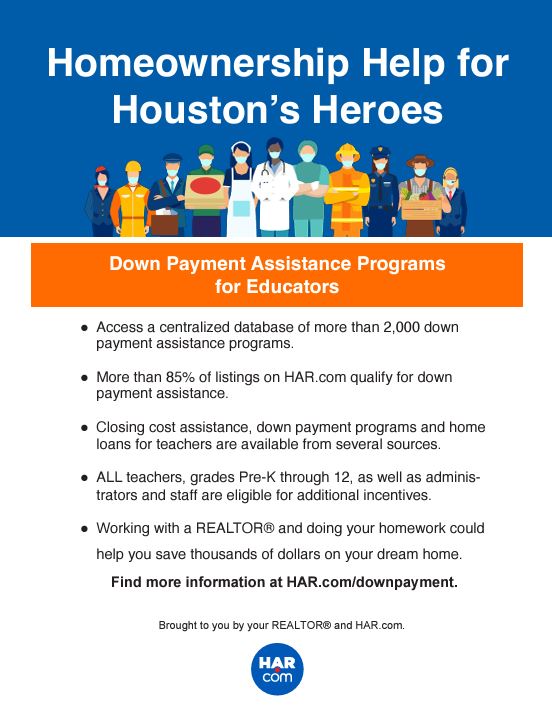

Down Payment Assistance

Explore down payment assistance programs to help reduce your costs of homeownership.

Learn more

Mortgage Calculator

Estimate your monthly mortgage payment and property taxes based on past rates.

Learn more