FOR CONSUMERS

The Reality of Real Estate

HAR.com is your home for the facts

The reality of real estate is that the market is always evolving. There is a lot of misinformation being reported about the National Association of REALTORS® (NAR) settlement. We want you to have the facts. HAR has put together valuable resources and information about the settlement’s impact on home buyers, sellers and renters as well as the benefits of working with a REALTOR®.

Frequently Asked Questions

Are agent commissions negotiable?

Yes. Compensation is currently negotiable and will continue to be negotiable. Compensation should always be negotiated between agents and the consumers they serve.

How does the settlement impact homebuyers?

MLS participants working on behalf of buyers would be required to enter into written agreements with their buyers before touring a home. These agreements can help consumers understand exactly what services and value will be provided, and for how much.

How does the settlement impact home sellers?

After the new rule goes into effect, listing brokers and sellers could continue to offer compensation for buyer broker services, but such offers could not be communicated via the MLS. The settlement expressly provides that sellers may communicate seller concessions — such as buyer closing costs — via the MLS provided that such concessions are not conditioned on the use of or payment to a buyer broker.

How does the settlement impact leases?

We are awaiting further clarification on how leases will be impacted. We will update you as soon as we get more information.

Do I need to sign a Buyer Representative Agreement to attend an Open House?

We are awaiting further clarification from NAR.

Is a buyer/tenant representative agreement required to show a rental property?

We are awaiting further clarification from NAR.

What do I do if my home is currently on the market?

After the new rule goes into effect, listing agreements should be amended to reflect that offers of compensation cannot be communicated via the MLS. The settlement expressly provides that sellers may communicate seller concessions — such as buyer closing costs — via the MLS provided that such concessions are not conditioned on the use of or payment to a buyer broker.

How will this impact VA loans?

- NAR recently submitted a letter to the Department of Veterans Affairs (VA) urging them to revise its policies pertaining to fees veterans cannot pay when using their VA home loan benefit.

- NAR specifically calls on the VA to allow their buyers to compensate their representative directly, which is currently prohibited under their policies. The letter stresses the importance of professional representation for veterans in the purchasing process and outlines the potential consequences for VA buyers in situations where compensation is not offered from a seller.

Does the settlement change access to mortgages for buyers?

No. Under the settlement, buyers still have the same options when it comes to compensating their real estate representatives. That is, the listing brokers can compensate the buyer broker, the seller can compensate the buyer broker, or the buyer can compensate their broker directly. Based NAR’s interpretation of current guidance, buyers should still be able to get financing from Fannie Mae, Freddie Mac, and the FHA under these scenarios. NAR is working to verify that this interpretation will hold. However, none of these agencies will allow the buyer to finance a commission into the mortgage at this time.

Can real estate commissions be financed?

According to NAR, financing commissions is not feasible under the current structure of the residential mortgage finance system, and there is no clear short-term legislative or regulatory fix.

Can a buyer request the listing broker to pay compensation to the buyer broker?

Yes. According to NAR, a buyer can request the listing broker to pay compensation to the buyer broker.

Do I need to use a REALTOR® to buy a home?

It is the consumers choice to use a REALTOR®. However, the services REALTORS® offer are invaluable, such as their expert guidance, market knowledge, negotiation skills, ability to tackle complex contracts and much more. You can navigate the real estate market with confidence when you have a REALTOR®.

Value of Using a

REALTOR®

REALTORS® enhance the home buying and selling journey with their valuable expertise and collaborative approach. A REALTOR® is your trusted advisor.

Find a REALTOR®

Resources for Homebuyers

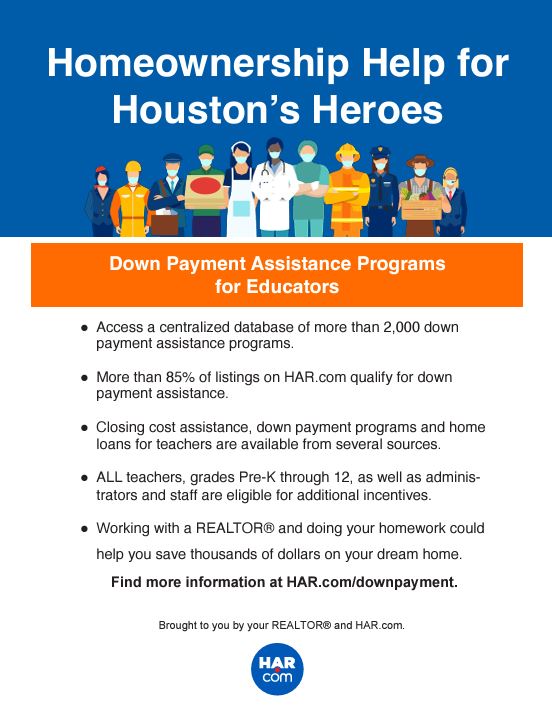

Down Payment Assistance

Explore down payment assistance programs to help reduce your costs of homeownership.

Learn more

Mortgage Calculator

Estimate your monthly mortgage payment and property taxes based on past rates.

Learn more